DAFTech: A Smarter

Donor Advised Fund.

AI-powered technology and a global service team - working together to deliver dramatic savings and scalability.

DAFTech combines AI-powered technology and full-service operational support to deliver a DAF experience your donors and staff will love — with lower costs, dramatic scalability, and seamless onboarding whether you're just starting out or moving beyond legacy tools and expensive vendors.

What is a Donor Advised Fund?

What makes DAFTech different?

DAFTech can help to manage and administer your DAF at a fraction of the traditional cost. That’s because our cutting-edge technology enables our backend team to perform operations in minutes instead of days:

Instant Fund Creation

In most systems, opening a new fund takes hours, sometimes even days. DAFTech does it instantly, with no manual setup required.

Payouts

Getting funds to grantees can take weeks through legacy vendors. We transfer them in minutes with full tracking and transparency.

Instant Deposits

Traditional platforms rely on manual processing and reconciliation for deposits. With us, it’s fully automated - funds are recorded and ready in real-time.

Lower Costs

DAFTech replaces manual processes and high-cost vendors with automation and in-house technology. The result: significantly lower operating costs without compromising on service or control.

Investing

In other systems, investment instructions and reporting are handled through offline forms and manual processes. With DAFTech, requests are submitted digitally and tracked in real-time, with no paperwork.

Granting

Grant approvals and nonprofit vetting often involve lengthy back-and-forth and manual reviews. We streamline the entire process so what used to take hours, now takes minutes.

Customer support

Most DAF providers expect your team to handle donor support manually. Our AI-assisted helpdesk gives donors real-time answers, 24/7.

Integrations

Managing donor data, marketing and finances often requires disconnected tools. DAFTech’s built-in CRM and marketing platform integrate seamlessly with your accounting system.

How DAFTech can help you

Whether you're a donor, an advisor, or an institution operating (or wanting to operate) a Donor Advised Fund, DAFTech can help you.

DAFTech empowers financial advisors, tax professionals, and estate planners to offer modern philanthropic solutions without taking on administrative complexity. Whether your clients are new to charitable giving or looking for a more strategic approach, DAFTech lets you stay at the center of the relationship while we manage the operations behind the scenes. You can deliver a branded, seamless Donor-Advised Fund experience that aligns with your clients' financial goals, enhances retention, and adds long-term value with zero operational lift on your side.

With DAFTech, advisors gain:

- Support for contributions — help clients donate cash or assets with tax efficiency and ease

- A fully branded giving solution — offered under your name, with no internal systems or staffing required

- Deeper client relationships — philanthropic planning strengthens the advisor-client bond over time

- No back-office burden — we handle contributions, grant processing, compliance, reporting and support

- Real-time transparency — view client fund activity and status through secure advisor dashboards

- More reasons for clients to stay — philanthropic engagement strengthens long-term loyalty

- Optional investment visibility — advisors can help guide how clients invest their DAF assets

- From contribution to grant — you stay the trusted advisor. We take care of the rest.

DAFTech enables institutions, including banks, foundations, nonprofits, and family offices, to offer a fully branded Donor-Advised Fund without building internal infrastructure or managing complex operations. Whether you're launching a new fund or upgrading an existing one, we provide the technology, compliance, and full-service operations while helping you reduce administrative costs by up to 40%. The result: a scalable, modern giving solution that lets you focus on growth, engagement, and donor experience.

With DAFTech, institutions gain:

- A branded DAF offering — delivered under your name, without the burden of setup or administration

- Higher assets under management — philanthropic capital remains invested over time, strengthening long-term engagement

- A seamless donor experience — online grantmaking, investment options, real-time dashboards, and 24/7 support

- Operational efficiency — we manage deposits, vetting, grant approvals, reporting, and donor service

- Significant cost reduction — up to 40% savings compared to in-house or legacy vendor models

- Flexible delivery models — keep full control, outsource completely, or choose a hybrid structure

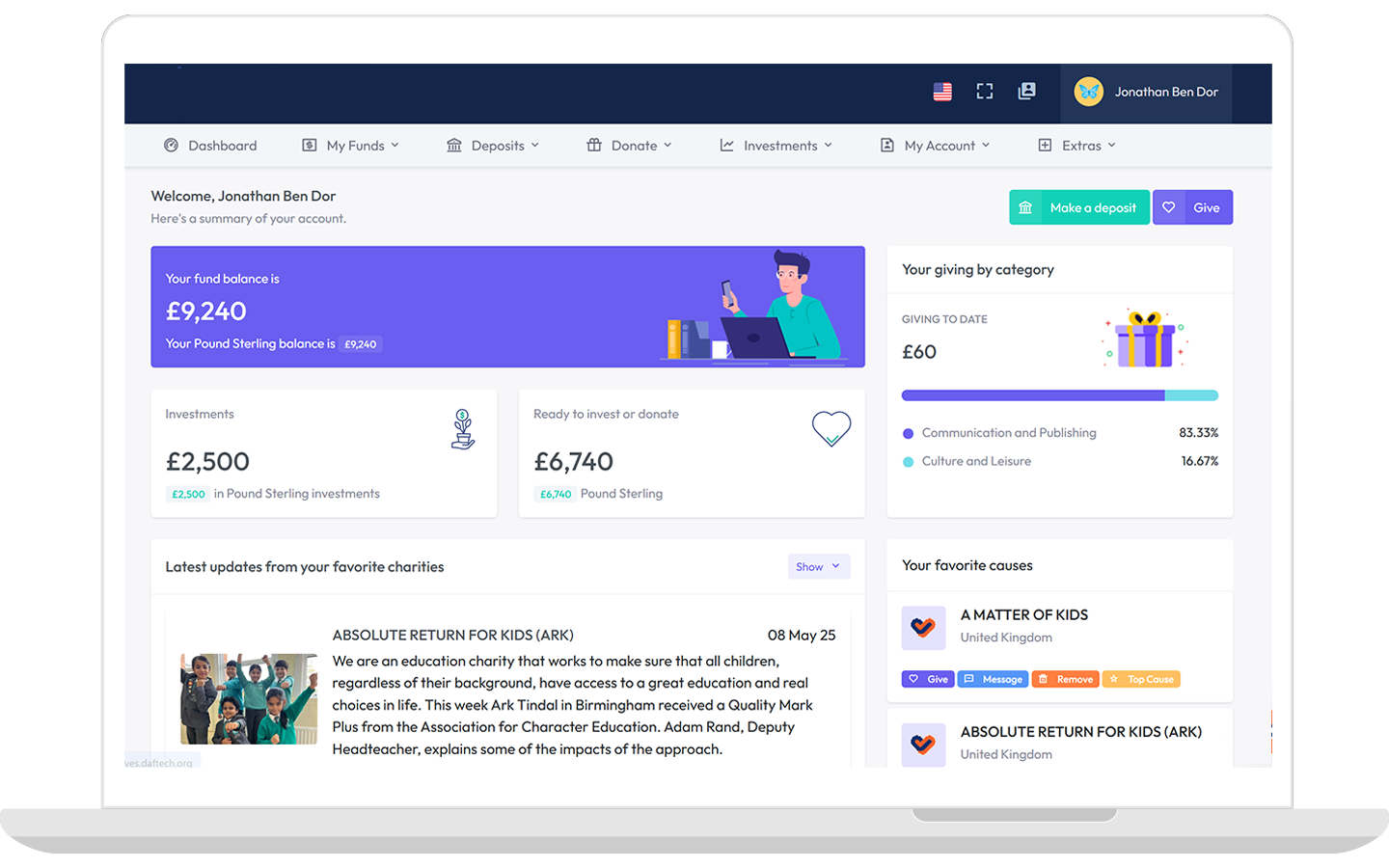

DAFTech gives donors a smarter, more flexible way to give with full control over timing, visibility, and impact. Whether donating cash, securities, or other assets, donors receive an immediate tax deduction and retain the freedom to recommend grants whenever they're ready. All activity, from contributions to investment performance to grant history, is tracked in one secure, easy-to-use platform. No paperwork, no delays, no uncertainty. You choose when to give, where to give, and how — DAFTech handles the rest

With DAFTech, donors gain:

- Immediate tax benefits — contribute assets now, decide on grants later

- Flexible contributions — donate cash, securities, or other assets easily and securely

- Investment options — let the fund grow tax-free until you're ready to recommend grants

- Real-time tracking — view balances, grant history, and investment performance in one place

- Seamless grantmaking — recommend grants online, with fast approvals and full transparency

- Always-on support — access real-time assistance whenever you need it

Why Organizations are Switching to DAFTech

DAFTech isn’t just better technology. It’s a better way to operate a DAF.

- Lower Operating Costs - Up to 60% savings across staffing, systems, and overhead, without compromising service.

- Faster Execution - Move from grant requests to approved payouts in minutes instead of days.

- Better Donor Experience - Real-time dashboards, online investing and 24/7 customer support.

- Flexible Operating Models - Use DAFTech to power your existing DAF, or launch a white-labeled fund through our partner charity.

DAFTech-as-a-Service - Three Flexible Models

Whether you're launching a new fund or modernizing an existing one, DAFTech gives you the operational support, technology and flexibility to choose the model that fits your institution best.

Your Brand, Our Charity

The fastest and easiest way to run your DAF. Our platform is white-labeled under your brand (e.g. “Smithtown Bank DAF”), while DAFTech serves as the legal sponsor and manages all operations and administration. You stay focused on your clients, we handle the rest.

Your Brand, Your Charity

Your charity remains the DAF sponsor, we power everything behind the scenes. Whether you're launching a fund or moving from existing systems, DAFTech manages all operations and administration, while your donors engage with a fully branded experience. No internal infrastructure required.

Our Tech, Your Team

You keep full control, we give you the tools to run it smarter. As the legal DAF sponsor, your charity remains responsible for custody, compliance, and grantmaking. With DAFTech’s platform, those responsibilities become far easier to manage with less overhead and better visibility.

Available Globally. Backed by

GivingTech is a global leader in philanthropic fintech, providing the infrastructure behind DAFTech. GivingTech provides tailored infrastructure for nonprofits and charitable foundations, supporting everything from CRM and marketing tools to task management, cross-border fundraising, and Donor-Advised Funds as well as other capabilities to run and scale giving programs.